A first look at how the Nationals bid allocation could shake out.

April 4, 2017 by Steve Sullivan in Rankings with 7 comments

USAU has posted their preliminary end-of-season college rankings that will determine the bid allocation for Regionals and Nationals; the rankings exclude all teams who failed to register ten sanctioned games during the regular season. USAU has also released a Google Doc with all omitted games for both gender divisions.

Teams have until 11:59 PM Mountain Time Wednesday night to review the rankings and submit corrections to scores or sort out eligibility issues.

Here’s a look at the rankings.

Women’s Division I

Implied Bid Allocation

AC: 2 bids

GL: 2 bids

ME: 1 bid

NC: 1 bid

NE: 2 bids

NW: 3 bids

OV: 2 bids

SC: 2 bids

SE: 1 bid

SW: 4 bids

Discussion

Very little drama here, as the results from this weekend made pretty clear how the Women’s D-I bid picture would shake out. Boston College’s ranking dropped due to the poor performance of some of their previous opponents, pushing Whitman into the final bid-earning position and giving the Northwest a third bid to Nationals. The Sweets’ one-point margin over Georgetown is closer than we anticipated1 and precarious enough that it could potentially change with any late score corrections.

Men’s Division I

Implied Bid Allocation

AC: 3 bids

GL: 1 bid

ME: 1 bid

NC: 3 bids

NE: 1 bid

NW: 4 bids

OV: 1 bid

SC: 3 bids

SE: 1 bid

SW: 2 bids

Discussion

As we projected, NC State, Cal Poly SLO, and Colorado State did enough this past weekend to earn bids for their respective regions. Purdue slots into the 20th spot, just a hair ahead of Central Florida.

But the big news today is that BYU has confirmed they plan to attend Conferences — with no intention of changing their policy of not playing on Sunday and so unable to qualify for Regionals — retaining the strength bid they earned for the Northwest and making the bid cutoff the 19th spot.2 While surely a disappointment to the Great Lakes, this opens the door for a Northwest team well outside the bid territory to make the trip to Cincinnati. The region’s fourth team, Oregon State, comes in at #29 in the final rankings, with previous qualifiers Western Washington and Utah also lurking in contention.

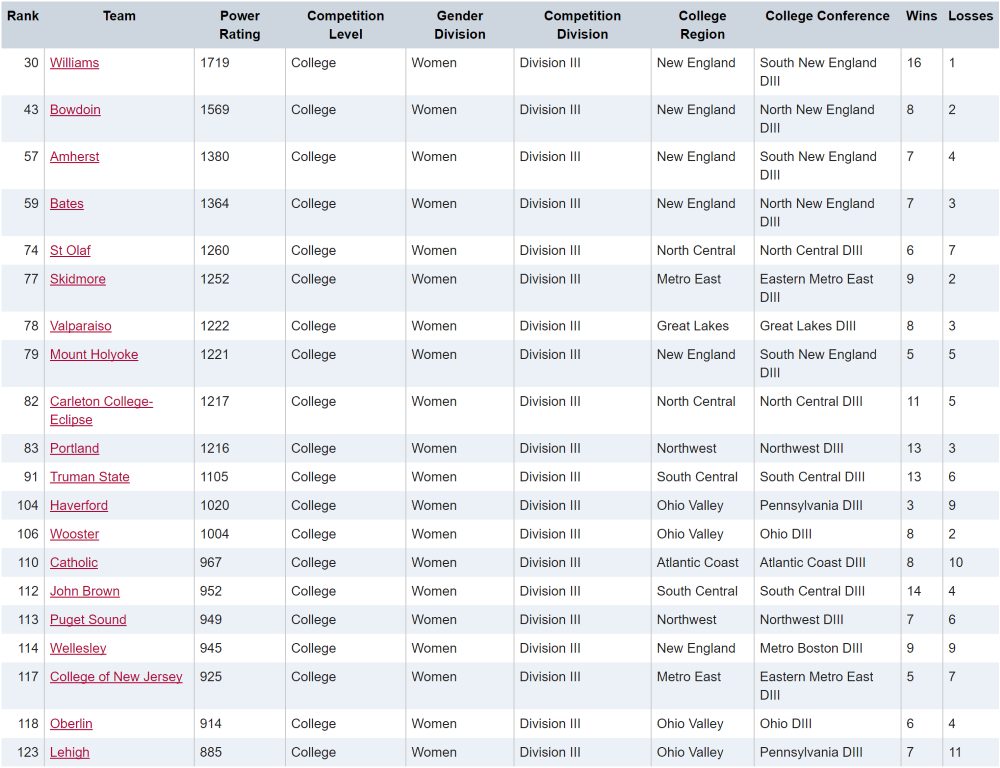

Women’s Division III

Implied Bid Allocation

AC: 1 bid

GL: 1 bid

ME: 1 bid

NC: 2 bids

NE: 4 bids

NW: 1 bid

OV: 2 bids

SC: 2 bids

SE: 1 bid

SW: 1 bid

Discussion

In the most dominant performance possible for a region, New England earns the max bid allocation by clocking in with the top four teams in the final D-III Women’s rankings — 100 points ahead of #5. Thanks to a new rule change this year, Mount Holyoke — who finish the season at #8 in the rankings — cannot earn a fifth bid for the region. With Wellesley also lurking inside the top 20, this should set up a wild Regionals tournament in New England.

With autobids allotted to the Southeast and Southwest despite not placing a team within bid-earning territory, the South Central’s John Brown lands as the last team inside the bid window, edging out the Northwest’s Puget Sound who are on the outside looking in.

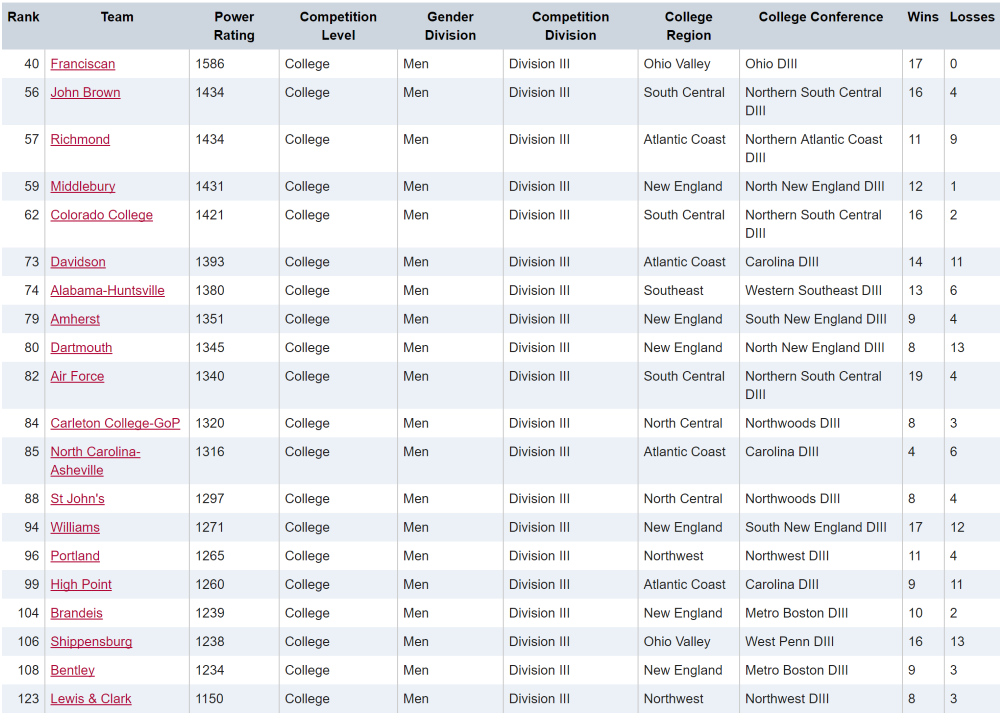

Men’s Division III

Implied Bid Allocation

AC: 3 bids

GL: 1 bid

ME: 1 bid

NC: 1 bid

NE: 3 bids

NW: 1 bid

OV: 1 bid

SC: 3 bids

SE: 1 bid

SW: 1 bid

Discussion

In D-III Men’s, four regions(!) do not qualify a team inside the top 16, placing the bid cutoff at #12. All of the strength bids are earned by either the Atlantic Coast, New England, or South Central. Currently North Carolina Asheville is the last team in, with St. John’s (MN) sitting on the bubble hoping for a change that brings a second bid to the North Central.

With a high degree of volatility for the division due to a number of ineligible games, loads of blowouts, and overall low connectivity, it is certainly possible that these rankings could fluctuate as USAU updates any incorrect scores and reviews eligibility in the next couple of days.

Editors note: A previous version of this article had miscalculated bids for Women’s D-III, awarding an extra strength bid to the Atlantic Coast instead of the South Central. This has been corrected.