Fascinating details about the finances and direction of the league.

October 29, 2020 by Charlie Eisenhood in News with 0 comments

The American Ultimate Disc League just announced a new equity crowdfunding campaign, enabling investors to buy shares in the league with an investment as low as $150. This follows a $500,000 raise two years ago on a different equity crowdfunding platform. Equity crowdfunding enables startups and private companies to raise capital from regular investors by selling securities, like shares, debt, or a revenue share.

Because the league is making ownership shares publicly available, they are required to file paperwork with the Securities and Exchange Commission with financial disclosures and information about the company. We’ve read through all of the information and pulled out 10 takeaways

1. The AUDL is making more revenue than ever before, but still losing over $800,000 a year.

In the grand scheme of professional sports, the AUDL is still a neophyte. The organization is seeking aggressive growth and is operating at a significant loss in order to do so. In the last two fiscal years, the league’s net income was -$829,480 and -$875,933, respectively.

However, the league has also seen explosive revenue growth since 2017.

With increased sponsorship deals, a six figure a year contract with Stadium in 2018 and 2019, and the launch of the AUDL.tv over-the-top streaming service in 2019, revenues have more than tripled since 2014. The league says that it projects to increase its revenue to over $1 million in 2021.

Keep in mind: these are only the financial details of the central league. Each team has its own revenues and expenses, which are not included in any of the above calculations.

2. The Deschutes Brewery title sponsorship deal is worth $400,000 over three years.

The AUDL announced its title sponsorship with Deschutes Brewery, a major craft beer company out of Bend, Oregon, at the end of the 2019 season. While earlier it had been described by league officials as a “low-to-mid six figure” deal, this is the first time a specific dollar amount was placed on the agreement: $400,000 over three years.

3. The league values itself at over $17 million.

In the WeFunder equity crowdfunding offering, the league priced its shares that set a valuation of the league at $17,165,016. Investors in this latest Series C fundraising round that got in early were offered a 15% discount on shares, which valued the company at $14,590,263.

These valuations are set by the league itself and not independently verified.

The SEC-mandated accounting filing says, as is standard in these types of public offerings, “The offering price of the Series C Common Units has been arbitrarily determined by Company’s management, without independent valuation, based on estimates of the price that purchasers of speculative securities, such as the Series C Common Units, will be willing to pay considering the nature of the Company and its capital structure, the experience of the officers and directors, and the market conditions for the sale of equity securities in similar companies.

“The offering price of the shares bears no relationship to the Company’s assets, earnings, or book value, or any other objective standard of value. Therefore, the Series C Common Units may have a value significantly less than the offering price, and Series C Common Units may never obtain a value equal to or greater than the offering price.”

4. The AUDL has raised nearly $6 million since its inception.

The AUDL, through equity fundraising rounds and loans, has raised $5.95 million since the league’s founding in 2012.

The majority of the investment has come via AUDL chairman Rob Lloyd and related entities, who purchased a controlling stake in the league in early 2013. The Lloyd-controlled Ultimate Xperience Ventures, LLC and the Steadman Lloyd Family Trust have invested over $5.3 million combined since 2013 through share purchases and loans, some of which are interest-free. The Steadman Lloyd Family Trust most recently invested $1,000,000 via a convertible note in September 2020.

Together, UXV and the Steadman Lloyd Family Trust control 64.7% of the organization’s voting power.

The league raised $500,000 in its previous Series B equity crowdfunding in 2018.

5. The league is expanding its marketing team and centralizing its approach.

Both 2018’s Series B fundraising round and this new Series C fundraising round were undertaken in order to increase the league’s marketing budget. The first $100,000 of the Series C round is going to be spent 90% on marketing, including the hiring of “one new marketing specialist.” 70% of the additional funds raised will be directed towards marketing efforts.

The league recently expanded its marketing department significantly, hiring President of Media and Marketing Tim DeByl away from his company, Distillery, and adding Adam Ruffner, Daniel Cohen, and Ashley Kouba as full-time employees in the department. The goal is to better support individual team franchises with marketing efforts organized by the AUDL front office.

“Historically, AUDL franchises have managed all marketing, ticket, and sponsorship sales locally at subscale,” the league wrote in its investor pitch deck. “The AUDL is working to increase team capital to invest more in fan acquisition. We will standardize and professionalize team marketing to grow revenues and profits.”

6. The league is betting big on sports gambling, fantasy, and games.

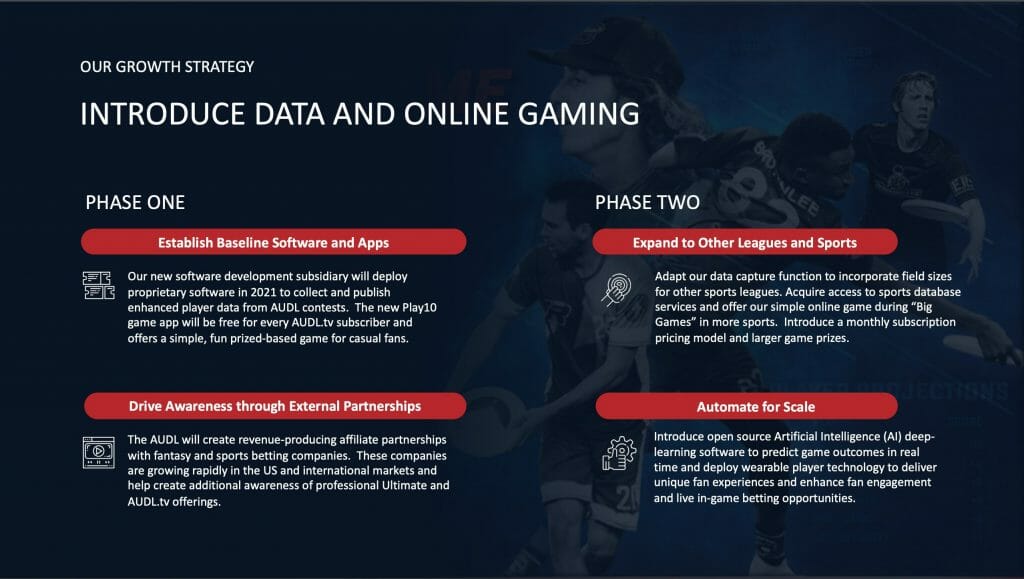

Throughout the investor pitch deck, the AUDL references sports gambling, fantasy sports, and significant investments in technology and statistics keeping to support the league’s move in that direction.

Here’s one slide from the deck:

The AUDL has started a subsidiary, UltiX Technology, LLC, that will continue to develop the league’s real-time statistics software and API.

“UltiX plans to offer new software products to monetize its AUDL licensed data and applications to further expand and engage the AUDL audience,” writes the AUDL on the WeFunder website.

Sports gambling has been increasingly legalized in states across the US since a Supreme Court ruling in 2018 lifted an effective ban on commercial sports betting. After years of avoiding any perceived connection to gambling, major sports leagues and teams have been partnering with gaming companies in deals worth millions of dollars.

The AUDL is also working with a game developer on a prototype of a console-based ultimate video game.

7. The league’s OTT streaming platform, AUDL.tv, had over 1,800 subscribers in its first year.

In 2019, the AUDL began streaming all of its games, the vast majority of which were only available via AUDL.tv for $9.99 a month. The new streaming service gathered over 1,800 paying subscribers in its first year, and the league estimates its average customer lifetime value at $80 per subscriber.

8. Bill Nye (yes, the Science Guy) has invested $50,000 in the AUDL.

Bill Nye is the lead investor in the Series C fundraising round, and he will have voting power on behalf of all Series C shareholders. He has invested $15,000 in the Series C round after previously investing $35,000.

“The flight of the disc in Ultimate is beautiful,” he wrote in a statement on the Wefunder campaign. “The lift, spin, and curved flights of the disc, combined with the athleticism of the players, create exhilaration— and heartbreak. As a former player at Cornell, and leader of the first Seattle team, I hope that introducing the AUDL to new fans will encourage even more kids to play ultimate in school, and more serious athletes to compete at every level. I predict that one day ultimate will become the top team action sport for everyone.”

Nye isn’t the only celebrity that’s involved with the AUDL: eight-time NFL first team All-Pro and four-time Super Bowl champion Ronnie Lott is on the league’s advisory board.

9. The AUDL’s “intent is to be profitable in 30 months.”

“American Ultimate Disc League, LLC cash in hand is $242,464.48, as of August 2020,” says the Wefunder disclosures. “Over the last three months, revenues have averaged $10,000/month, cost of goods sold has averaged $5,000/month, and operational expenses have averaged $32,000/month, for an average burn rate of $27,000 per month. Our intent is to be profitable in 30 months.”

10. Maestroe Sports and Entertainment, the AUDL’s national sports marketing partner, just invested in the league.

Maestroe Sports and Entertainment — which has brokered multiple sponsorship agreements for the AUDL, including with Deschutes, Tiger Balm, and VII Apparel Company (formerly Savage) — just invested in the Series C round for an undisclosed amount.

“We are very bullish on the AUDL,” said Maestroe President Gabby Roe in a press release. “The management team is top notch and we believe this league has only just begun to scratch the surface of its potential. We have seen and worked with hundreds of new, emerging sports properties over the years and we put the AUDL right up there with the best of them.”

Subscribe to Ultiworld to receive In The Zone, a monthly business newsletter written by editor-in-chief Charlie Eisenhood. November’s newsletter will have more on the AUDL and its direction.